How Is An Llc Taxed In Texas . Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. Find out the different tax categories, rates, exemptions, and. The tax rate for businesses other than retail and wholesale is 0.75%. learn about the different types of taxes llcs in texas will be subject to, such as franchise tax, sales tax, and employer taxes. the tax for wholesalers and retailers is 0.375%. your texas llc is subject to state taxes, federal taxes and possibly sales taxes. Texas doesn’t have a state income tax, but it. by default, a texas llc is taxed by the internal revenue service (irs) based on the number of members the llc. In these cases, the tax is. learn how to pay taxes as an llc in texas, including local, state, and federal taxes. texas llc tax filing requirements will vary based on how your business chooses to be taxed. So, the llc's income passes.

from howtostartanllc.com

texas llc tax filing requirements will vary based on how your business chooses to be taxed. the tax for wholesalers and retailers is 0.375%. Find out the different tax categories, rates, exemptions, and. Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. The tax rate for businesses other than retail and wholesale is 0.75%. learn about the different types of taxes llcs in texas will be subject to, such as franchise tax, sales tax, and employer taxes. your texas llc is subject to state taxes, federal taxes and possibly sales taxes. learn how to pay taxes as an llc in texas, including local, state, and federal taxes. In these cases, the tax is. Texas doesn’t have a state income tax, but it.

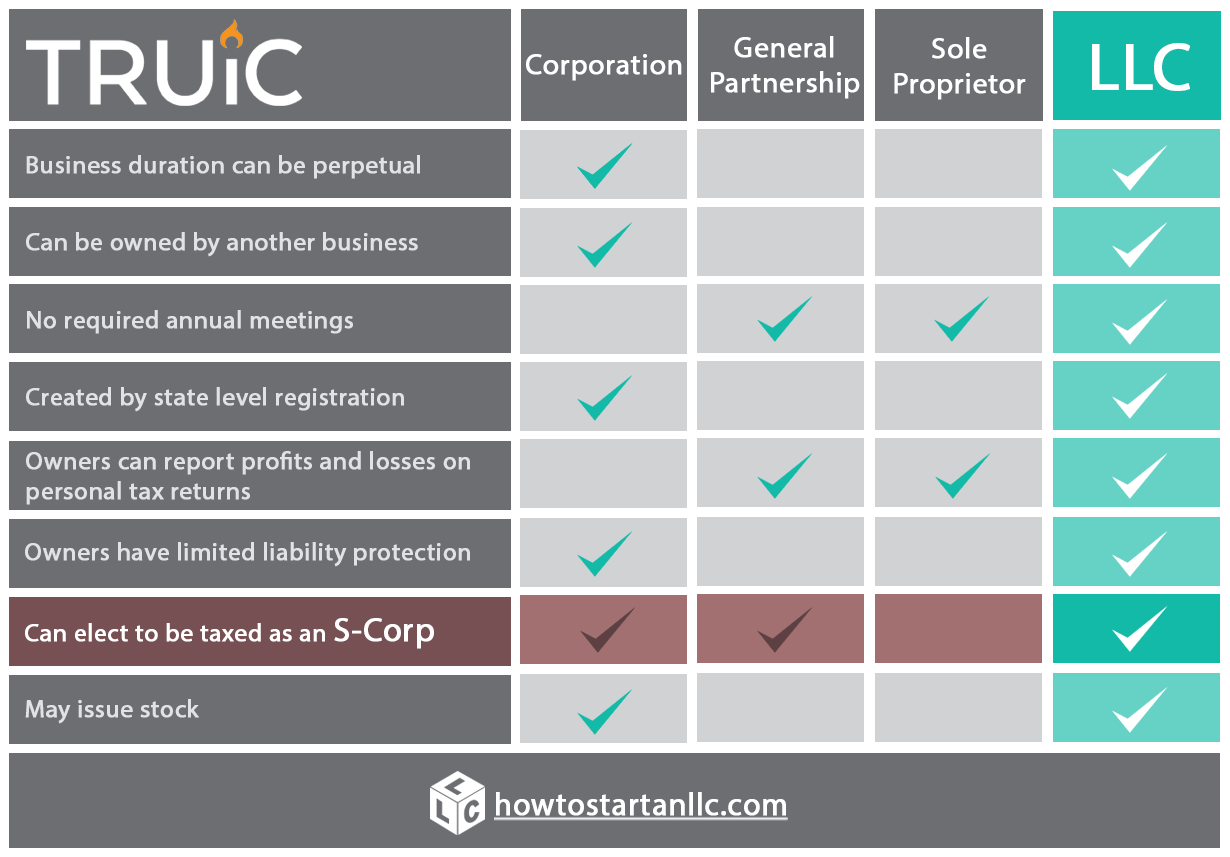

What is an LLC How to Start an LLC

How Is An Llc Taxed In Texas Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. In these cases, the tax is. learn about the different types of taxes llcs in texas will be subject to, such as franchise tax, sales tax, and employer taxes. learn how to pay taxes as an llc in texas, including local, state, and federal taxes. The tax rate for businesses other than retail and wholesale is 0.75%. texas llc tax filing requirements will vary based on how your business chooses to be taxed. Find out the different tax categories, rates, exemptions, and. the tax for wholesalers and retailers is 0.375%. by default, a texas llc is taxed by the internal revenue service (irs) based on the number of members the llc. Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. So, the llc's income passes. Texas doesn’t have a state income tax, but it. your texas llc is subject to state taxes, federal taxes and possibly sales taxes.

From www.simplifyllc.com

LLC for Investing (StepbyStep Guide for Beginners) SimplifyLLC How Is An Llc Taxed In Texas Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. texas llc tax filing requirements will vary based on how your business chooses to be taxed. by default, a texas llc is taxed by the internal revenue service (irs) based on the number of members the llc. your texas llc. How Is An Llc Taxed In Texas.

From www.pinterest.com

How Do LLCs Get Taxed? Choosing a Tax Structure for Your LLC Llc How Is An Llc Taxed In Texas learn how to pay taxes as an llc in texas, including local, state, and federal taxes. In these cases, the tax is. texas llc tax filing requirements will vary based on how your business chooses to be taxed. Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. Texas doesn’t have. How Is An Llc Taxed In Texas.

From nomadcapitalist.com

LLC Taxation for NonUS Residents in 2024 The Ultimate Guide How Is An Llc Taxed In Texas learn how to pay taxes as an llc in texas, including local, state, and federal taxes. Find out the different tax categories, rates, exemptions, and. Texas doesn’t have a state income tax, but it. learn about the different types of taxes llcs in texas will be subject to, such as franchise tax, sales tax, and employer taxes. The. How Is An Llc Taxed In Texas.

From storage.googleapis.com

Navigating Texas LLC Taxation What You Need to Know How Is An Llc Taxed In Texas learn about the different types of taxes llcs in texas will be subject to, such as franchise tax, sales tax, and employer taxes. your texas llc is subject to state taxes, federal taxes and possibly sales taxes. So, the llc's income passes. the tax for wholesalers and retailers is 0.375%. In these cases, the tax is. Find. How Is An Llc Taxed In Texas.

From vennlawgroup.com

LLC Taxation Options Which is best for your business? Venn Law Group How Is An Llc Taxed In Texas the tax for wholesalers and retailers is 0.375%. texas llc tax filing requirements will vary based on how your business chooses to be taxed. Find out the different tax categories, rates, exemptions, and. The tax rate for businesses other than retail and wholesale is 0.75%. Find out how to calculate, pay, and file your taxes correctly and stay. How Is An Llc Taxed In Texas.

From www.financestrategists.com

LLC Taxed as S Corp How It Works and Factors to Consider How Is An Llc Taxed In Texas Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. texas llc tax filing requirements will vary based on how your business chooses to be taxed. The tax rate for businesses other than retail and wholesale is 0.75%. Texas doesn’t have a state income tax, but it. In these cases, the tax. How Is An Llc Taxed In Texas.

From wealthnation.io

Guide] All You Need To Know About Creating An LLC For How Is An Llc Taxed In Texas So, the llc's income passes. In these cases, the tax is. learn how to pay taxes as an llc in texas, including local, state, and federal taxes. The tax rate for businesses other than retail and wholesale is 0.75%. Find out the different tax categories, rates, exemptions, and. by default, a texas llc is taxed by the internal. How Is An Llc Taxed In Texas.

From www.business-advice-guide.com

How Is an LLC Taxed? Everything You Need to Know Business Advice Guide How Is An Llc Taxed In Texas Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. The tax rate for businesses other than retail and wholesale is 0.75%. your texas llc is subject to state taxes, federal taxes and possibly sales taxes. texas llc tax filing requirements will vary based on how your business chooses to be. How Is An Llc Taxed In Texas.

From howtostartanllc.com

What is an LLC How to Start an LLC How Is An Llc Taxed In Texas the tax for wholesalers and retailers is 0.375%. Texas doesn’t have a state income tax, but it. In these cases, the tax is. by default, a texas llc is taxed by the internal revenue service (irs) based on the number of members the llc. learn about the different types of taxes llcs in texas will be subject. How Is An Llc Taxed In Texas.

From eqvista.com

LLC Taxation Corporate and Single member filing requirements Eqvista How Is An Llc Taxed In Texas The tax rate for businesses other than retail and wholesale is 0.75%. learn how to pay taxes as an llc in texas, including local, state, and federal taxes. texas llc tax filing requirements will vary based on how your business chooses to be taxed. the tax for wholesalers and retailers is 0.375%. Find out how to calculate,. How Is An Llc Taxed In Texas.

From www.simplifyllc.com

What is an LLC and How Does it Work SimplifyLLC How Is An Llc Taxed In Texas your texas llc is subject to state taxes, federal taxes and possibly sales taxes. So, the llc's income passes. learn how to pay taxes as an llc in texas, including local, state, and federal taxes. The tax rate for businesses other than retail and wholesale is 0.75%. Find out how to calculate, pay, and file your taxes correctly. How Is An Llc Taxed In Texas.

From ebizfiling.com

Everything you need to know on "What is the LLC Tax Rate?" How Is An Llc Taxed In Texas The tax rate for businesses other than retail and wholesale is 0.75%. learn how to pay taxes as an llc in texas, including local, state, and federal taxes. learn about the different types of taxes llcs in texas will be subject to, such as franchise tax, sales tax, and employer taxes. Find out the different tax categories, rates,. How Is An Llc Taxed In Texas.

From howtostartanllc.com

What is an LLC Limited Liability Company (LLC) TRUiC How Is An Llc Taxed In Texas Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. Texas doesn’t have a state income tax, but it. Find out the different tax categories, rates, exemptions, and. your texas llc is subject to state taxes, federal taxes and possibly sales taxes. by default, a texas llc is taxed by the. How Is An Llc Taxed In Texas.

From www.mycorporation.com

LLC vs. Corporation What is the difference between an LLC and a How Is An Llc Taxed In Texas learn how to pay taxes as an llc in texas, including local, state, and federal taxes. learn about the different types of taxes llcs in texas will be subject to, such as franchise tax, sales tax, and employer taxes. your texas llc is subject to state taxes, federal taxes and possibly sales taxes. by default, a. How Is An Llc Taxed In Texas.

From www.businesspundit.com

Complete 13Step Guide for Starting an LLC in Texas How Is An Llc Taxed In Texas In these cases, the tax is. Texas doesn’t have a state income tax, but it. learn about the different types of taxes llcs in texas will be subject to, such as franchise tax, sales tax, and employer taxes. by default, a texas llc is taxed by the internal revenue service (irs) based on the number of members the. How Is An Llc Taxed In Texas.

From www.simplifyllc.com

How to Start an LLC in Texas StepByStep How Is An Llc Taxed In Texas the tax for wholesalers and retailers is 0.375%. texas llc tax filing requirements will vary based on how your business chooses to be taxed. by default, a texas llc is taxed by the internal revenue service (irs) based on the number of members the llc. Texas doesn’t have a state income tax, but it. So, the llc's. How Is An Llc Taxed In Texas.

From learn.financestrategists.com

LLC Taxed as an S Corporation An Option You May Not Know You Have How Is An Llc Taxed In Texas texas llc tax filing requirements will vary based on how your business chooses to be taxed. So, the llc's income passes. Find out the different tax categories, rates, exemptions, and. Texas doesn’t have a state income tax, but it. In these cases, the tax is. The tax rate for businesses other than retail and wholesale is 0.75%. by. How Is An Llc Taxed In Texas.

From www.financestrategists.com

LLC Taxed as S Corp How It Works and Factors to Consider How Is An Llc Taxed In Texas your texas llc is subject to state taxes, federal taxes and possibly sales taxes. Find out how to calculate, pay, and file your taxes correctly and stay compliant with texas law. the tax for wholesalers and retailers is 0.375%. Texas doesn’t have a state income tax, but it. texas llc tax filing requirements will vary based on. How Is An Llc Taxed In Texas.